You should be aware that you may lose a significant portion of your portfolio. This risk is higher with Cryptocurrencies due to markets being decentralized and non-regulated. Trading in any type of financial product including forex, CFDs, stocks, and cryptocurrencies. Trading Risk Disclaimer: There is a very high degree of risk involved in trading securities. This is based on your retirement savings and your inflation adjusted withdrawals. Investment advice disclaimer: The information contained on this website is provided for educational purposes, and does not constitute investment advice. Use this calculator to see how long your retirement savings will last. Moreover, you can also check how many times can you withdraw from a savings account. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Use this calculator to determine how long those funds will last given regular withdrawals. We designed the present savings withdrawal calculator to find the answer to all the above questions. Between 74-89% of retail investor accounts lose money when trading CFDs. We may receive compensation when you click on links to products we reviewed.ĮSMA: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. How long will your retirement nest egg last How much could your investments grow Answer a few questions to. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. This information may help you analyze your financial needs.

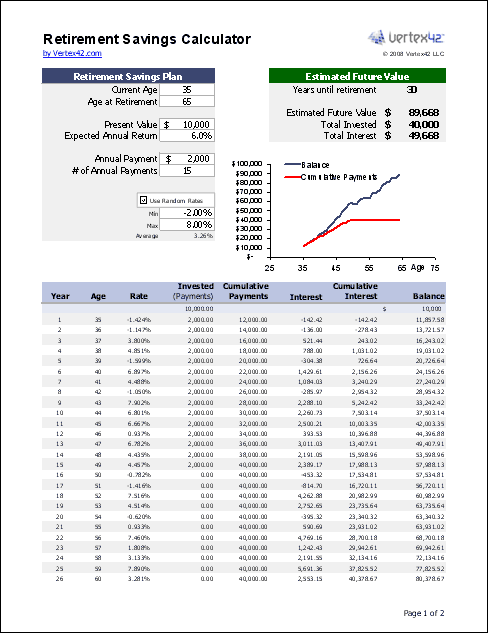

So, in 25 years you'll have saved about $2,702,947.50. You think you can earn 5% per year in retirement and assume inflation will average 3.5% per year. You decide to increase your annual withdrawal by 3.5%, and want the money to last for 35 years with nothing left for heirs after that time.Advertiser Disclosure: Securities.io is committed to rigorous editorial standards to provide our readers with accurate reviews and ratings. Simply enter the starting balance, the number of consecutive losses and the loss per trade (in percent) to calculate the expected drawdown. Use this calculator to determine how long those funds will last given regular withdrawals. You are also contributing to a 401(k) and after using my 401(k) Calculator found it will be worth about $120,000 by the time you retire at 65. You also have $500,000 in IRAs (between the two of you) and will continue to contribute $8,000 ($4,000 each spouse) each year until you retire at 65. You're earning 5% per year on your taxable and IRA money and expect that to continue.Īfter using my Savings Calculator, you found that you will have $2,582,947.50 (between your taxable account and IRAs) in 25 years. You and your spouse currently have $150,000 in a taxable account to which you're no longer contributing. You're 40 years old and would like to retire at 65 (in 25 years). Your spouse will retire with you.This calculator will help you to figure out how long your retirement savings. Social security is calculated on a sliding. View your retirement savings balance and calculate your withdrawals for each year. You will be able to withdraw the equivalent of $25,448.65 (in today's $) at the beginning of each year. That seems pretty good. You also remembered you'll be getting Social Security benefits, so all is well! (Assuming all the above assumptions are met, of course.) Maintaining your lifestyle in retirement requires careful, long-term planning. Use this retirement calculator to create your retirement plan. (You think you'll live to 100 years old.)

0 kommentar(er)

0 kommentar(er)